A 50 Year Solution to an Immediate Affordability Crisis

The President has suggested a 50-year mortgage to help homebuyers, which has been met with some knee-jerk dismissiveness. The 50-year mortgage is not a solution on its own, but could be a useful tool with some tweaks:

- For first-time homebuyers only

- Cap the mortgage size so that it is generally suitable to entry-level homes

- Lower the mortgage rate with government intervention

- As little as 10% down

- Make it a 2 part mortgage, with a smaller piece that can be prepaid more easily

- Primary residence for 2 years, but after that allow the flexibility of converting to a rental

Other policies that could help:

- Build more homes. Build smaller homes. Tie generous federal housing aid to new home production.

- Limit competition from institutional buyers

The 50-Year Mortgage: Examining America’s Latest Housing Affordability Proposal

As American homeownership becomes increasingly unattainable for younger generations, the Trump administration has proposed introducing a 50-year mortgage option to help address the housing affordability crisis. With the average age of first-time homebuyers reaching a record high of 40 years old, policymakers are searching for solutions to unlock the market for aspiring homeowners priced out by high interest rates and soaring property values. A 50-year mortgage could be a good option for some, though not a solution to the crisis without building more homes particularly in high demand areas.

The Basic Premise: Lower Payments, Longer Commitment

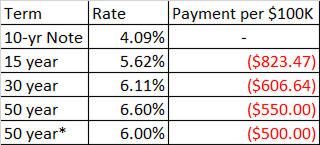

The mathematics are straightforward: spreading payments over a longer period reduces the monthly burden. This would give buyers more purchasing power. The program should be tailored to first-time homebuyers to get them out of renting and into owning, building equity in real estate, and adopting an investment mindset.

Criticism 1: Any initial benefit will be lost when the added purchasing power just pushes prices higher.

By limiting the 50-year to first-time buyers, currently about 1/4 of homebuyers, the crowding effect would be lessened. First-time buyers as a group are less wealthy than older, repeat homebuyers, putting a natural ceiling on their ability to bid-up properties.

Capping the mortgage size to, for example, the median home price in the US of about $327K or the average in an area like NYC of $800K, would also put a damper on upward pressure on prices and maintain a focus on entry-level homes.

Add a low down-payment option like 10% to give these buyers even more purchasing power and we enhance the benefit of a 50-year mortgage.

Criticism 2: The long pay back period means a lifetime of debt, defaults, and higher interest payments

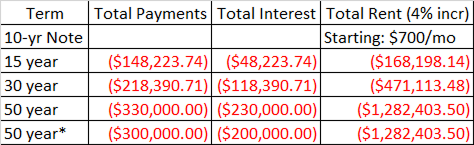

A fair criticism is to point out the amount of interest a borrower will have to pay over the life of the loan. In this example, borrowing $100K will cost about $50K in interest for 15 years, $120K for 30 years, and $230K for 50 years!

Many mortgages in fact are prepaid, either paid off ahead of schedule, refinanced when rates dip, or paid off when the home is sold. There is a high likelihood that these 50-year mortgages, if used for smaller entry-level homes, and given their long payback period, will be prepaid.

The alternative to buying of course is renting. Starting with a monthly rent of $700/mo and assuming 4% increases, a purchaser could “save” nearly $1 million instead of renting over the course of 50 years.

Require a minimum of 2 years where the borrower must live in the home to qualify for the loan. After that however, they can rent out the home and turn it into a cash flow generating asset. The renter covers the mortgage, ideally with positive cash flow. The property could later become a primary residence once again, or a cornerstone of a growing investment portfolio along with an IRA account.

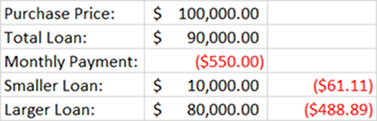

Another added feature could be to structure the 50-year mortgage as two parts, one small and one large. The smaller part could be paid off early leaving the borrower with an even more manageable mortgage payment. Here is an example:

So in this example, the total minimum payment is $550/mo. Making only the minimum payments both loans will be paid off over 50 years, but if the borrower has the ability to prepay they can pay off the smaller loan early with $10K or less. Once they have paid off the smaller loan their remaining fixed payment is now “only” $488.89. This would likely reduce the chances of a default down the road, and perhaps even allow them to make accelerated payments on the remaining piece of the loan. With a incentive to pay off the smaller loan early, borrowers could give their equity a bump and help ensure fewer underwater mortgages.

For many homeowners, however, it is appreciation in their home that builds wealth over time. For example, a renter for 30 years would have no equity in their home. A homeowner for 30 years might see their home value double based on an annual appreciation rate of just 4%.

Finally, I would propose the government provide these first-time 50-year mortgage borrowers with an artificially lower borrowing rate. In my example a 6.6% 50-year rate might become 6% effectively reducing the monthly payment, and cumulative interest. This still reflects about a 200bps premium over the current 10-year benchmark.

Criticism 3: Will banks and investors buy in?

Understandably, banks and investors might not like holding 50-year mortgages given the long tail-risk. Banks could be given the task of underwriting the loans (which they do already for FHA, VA and other loans) but the government could guaranty the mortgages, perhaps even hold them as investments for the social security system. Essentially the interest payments would help fund the retirements of borrowers when they eventually retire. Payments and payoffs could allow capital to be reallocated to new home buyers. Banks would not be expected to hold the loans on their own books or syndicate them for investors.

Given the long life of the mortgage, banks could be instructed to apply tight underwriting standards. This would not stop buyers from taking out 30 year mortgages if they don’t qualify.

These loans would not be for everyone, not even all first time homebuyers. If 25% of all buyers are first time homebuyers, then perhaps this program could help boost that share by +5%. That would be a very meaningful boost, but 95% of purchases would use existing mortgage options.

It should also be noted that multiple countries have tried mortgages longer than 30 years with mixed success including Japan and several European nations. Switzerland even has a 100 year multi-generational mortgage.

Other policies that could help:

- Build more homes and build smaller homes. Tie generous federal housing aid to new home production.

- Limit competition from institutional buyers (private equity)

In many markets, new homes are relatively unaffordable, while older homes require costly renovations. One solution to making new homes more affordable would be to make them smaller. Whereas new homes in the 1950s may have been 800 SF, new suburban homes today average 2500 SF. Smaller houses and apartments are inherently less expensive to build and can be offered at more approachable price points. A cap on 50-year loan sizes could invite builders to build to that price point, as well as government incentives like tax abatements that are tied to affordability. Cities should continue to encourage the creation of larger cluster housing around transit hubs. The federal government could provide generous incentives to states and municipalities that make significant contributions to the housing supply, particularly in high demand areas.

In some markets, first time homebuyers are finding themselves in direct competition with large institutional buyers like private equity funds that buy single family homes that are then rented for income. These institutional buyers can pay asking or above asking, all cash (no financing), with fast closings. It is virtually impossible for a first-time homebuyer to compete financially. Some cities and states have proposed banning these institutional buyers. We should be very wary of outright bans. However, there is something inherently unfair about institutions bidding for entry-level, single family homes and turning entire neighborhoods into large-scale rental communities. It is an entirely different story if these investors are helping the situation by replacing single family homes with multi-family homes, converting a large townhouse into multiple affordable apartments, and rehabilitating old housing under current housing building codes.

Conclusion

The United States has something around a 4 million unit shortage of homes. That imbalance in supply/demand must be tackled to bring housing costs down, primarily by adding large numbers of housing units to the supply. That, combined with other policies like a 50-year mortgage for first time homebuyers, and we could see a massive improvement in housing affordability across the nation.